In Part 1 of this Series I explained why I think current solar installation forecasts from big groups like IEA and BNEF are overly conservative. I flagged how these forecasts being overly conservative don’t just impact the solar industry, but other industries as well. Metals industries are highly-leveraged to the solar industry and in parts 2 and 3 I discussed the impact of solar installation forecast scenarios on Copper, Aluminium, Silver and Antimony demand. This time I’m going to look at the impact on BESS installations and Lithium demand forecasts.

In Part 1 I described four scenarios for solar installations over the next 10 years. They were:

- Ultra-Conservative Scenario (UCS): 8.1% per annum – that’s what all the “experts” suggest, but I think they’re way out of the money.

- Base-Case Scenario (BCS): Let’s say 15% per annum between 2025-35E. That’s double the consensus growth rate but half the 10-year growth rate.

- Optimistic Scenario (OS): Let’s make this 20% per annum between 2025-35E. That’s pretty racey for a 10-year period, but it’s not outside the realms of possibility given the magnitude of what needs to be done.

- Uber-Optimistic Scenario (UOS): I’m going for 30% per annum for the 2025-35E period. That’s still below the average growth rate for the past 5 years, but in line with what we’ve seen over the past 10 years.

Now it’s time to apply those forecasts for solar installations firstly to BESS (Battery Energy Stationary Storage) and then, by extension, to lithium demand.

How BESS installations are related to solar

So there are different types of BESS:

- Standalone BESS that is independent of any generation asset and is connected directly to the grid or behind the meter (normally in a Commercial&Industrial setting);

- Hybrid BESS that is generally paired with renewables. It charges from excess solar or wind power production and then discharges during peak demand periods;

- Behind the Meter (BTM) BESS which is installed on the customer side of the electricity meter. This can be C&I or Residential, both important subsets – as opposed to Utility-scale BESS;

In this instance when we’re forecasting BESS installations related to Solar, we’re mostly talking about Hybrid and BTM systems, although in actual capacity terms, hybrid totally dominates the other categories.

While it’s pretty easy to get data on Hybrid BESS installations, it’s very difficult to get any data on how much of annual BESS installations are directly linked to solar installations. So we need to make an approximation in our calculation and we’ve used 40% in 2024, rising by a few percentage points over time. That then allows us to calculate a BESS/Solar installations ratio which we can use to link BESS installations directly to solar installations.

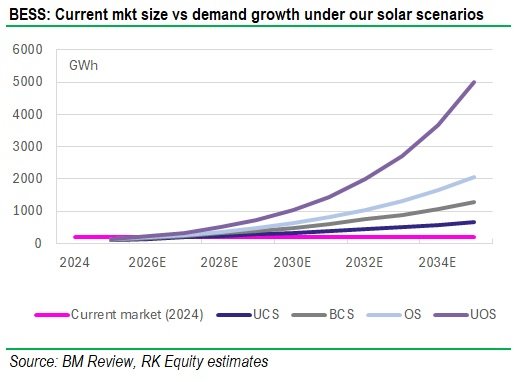

Our calculations suggest that annual BESS installations related to solar could vary between 659GWh in 2035E under our UCS, to 5000GWh in 2035E under our UOS. That’s quite some range and particularly relevant given that the market size was c.200GWh in 2024. So we’re either talking about a trebling of the current market in 10 years or a 25x increase in the current market size…!

Actually, the scenario in our UOS isn’t more than 10% higher than what I already include in my models for BESS installations in 2035E, but that’s because I already disregarded consensus forecasts on solar!

But that only tells half the story, because the total BESS market size under UOS (including the higher solar-related forecasts) could be upwards of 8000GWh (our calculated installations for solar added to installations for wind and installations for Residential and C&I), which is “quite large”. And, if that’s pretty seismic, what sort of impact does that have on lithium demand?

Impact on Lithium demand from solar installations forecast

So, I noted above how substantial the impact could be on the BESS industry of higher solar installation forecasts. I also noted that this scenario analysis wasn’t the whole story, because there were also other drivers of BESS.

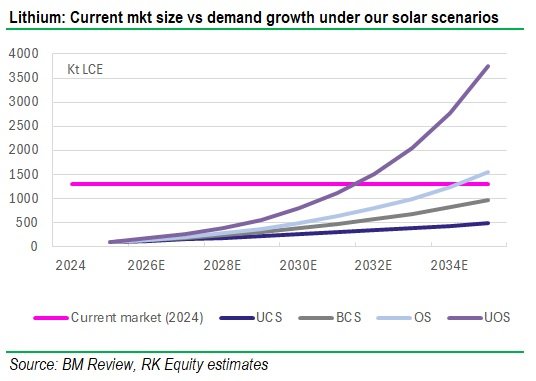

We also have that situation in Lithium. Please note that the Lithium demand curve that I show below is just for solar-related BESS. It does not include BESS related to Wind or Standalone BESS or BTM BESS. But it is also important to note that it also doesn’t include Lithium demand for consumer products batteries, for other applications, or for EV batteries.

If we add in lithium demand for other applications, while it tightens up the Supply/Demand gap slightly in the next five years, it pushes the Supply/Demand gap into a quite substantial imbalance in the 2030s in our OS and UOS. And, given the current low pricing environment and cancellation of lithium development projects, as well as the time to market for new projects, that suggests that the good times could return for lithium in quite a substantial way!

We’ll be publishing more on this in the coming months but I just wanted to throw this out there because I think that BESS is one of the areas which is being forecasted the least well by sell-side analysts. It is difficult to forecast anyway, and it’s particularly difficult to forecast if solar installation forecasts are too conservative and we feel that that’s very much the case. A I noted in the first section of this series, the magnitude of the change in economics not only for solar, but also for solar+storage is not being as well recognised as I believe it should be in the market. And, as a result, I believe most analysts are substantially understating demand for BESS and hence for battery raw materials.