What a difference a year makes

2025 was very much a year of two halves for the lithium sector, and also for me personally. I formally joined RK Equity in mid-2025, at a time when the platform was expanding both the scope and cadence of its analytical output.

The December 2025 issue of Battery Materials Review was the eighty-nineth consecutive monthly issue of the newsletter, stretching all the way back to August 2018. But now, as part of the evolution of RK Equity, Battery Materials Review is transitioning from a monthly to a quarterly format, reflecting a more deliberate, cycle-focused approach to market analysis.

Historically, I have published an annual outlook that also served as the lead article for BMR, combining forward-looking views with a candid assessment of what I got right and wrong in the year prior. The article below would have been the lead in the January 2026 issue of BMR, but I include it here for your reading pleasure.

2026 outlook, 2025 recap

As we move into 2026 and wonder what the outlook is for the battery and battery raw materials sector, I’m struck by something which I flagged as a key theme for 2025, namely the emergence of a two-tier Energy Transition.

When I was writing my 2025 outlook piece last January, I flagged two points that I thought were going to dominate the discussion in 2025; geopolitics and the emergence of the two-tier transition. And, unfortunately, both thematics were important in 2025, and they also both look like they will continue to be so in 2026.

The US and the two-tier transition

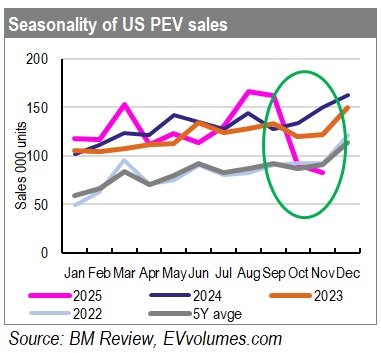

It took a little longer than I had expected for the weakness in US EV demand to emerge in 2025. I had it expected it by mid-year; it was actually only in the fourth quarter that it arrived. But 2026 now looks set to be quite a weak year for US EV sales.

In addition, anti-China rhetoric in the US has ramped up a long way and, with the effect of tariff policy, we see a genuine two-tier cost structure starting to emerge between the US and the rest of the world.

As I write this article, the US has arrested the Venezuelan president, continues to posture on Greenland and is making noise on Iran. It’s fair to say that there are large-scale geopolitical uncertainties around US policy in a way that we have not seen for decades. The actions of the Trump Administration in 2025 vis a vis its allies as well as its enemies imply that the US is likely to veer more towards isolationism over coming years and I wonder how that will impact the battery supply chain?

Will Canada’s supply chain end up pointing much more towards Europe than the US? What will happen in left-leaning Brazil? In Africa? These are all questions the answers for which are likely to emerge over the course of this year.

While initially dismissive of batteries because of their association with EVs, there has been some movement in the Trump Administration towards understanding that lithium-ion batteries are vital for defence applications and also for power infrastructure, even though the Administration remains hostile to renewables. While the Administration itself remains firmly in the Fossil Fuel camp, privately run utilities continue to recognise the economics and speed to market benefits of investing in renewables and I’m confident that batteries will remain a key aspect of that, going forward.

2025 saw a number of US cell manufacturing plants flip from EV to ESS cells, some even moving from ternary to LFP chemistries. Given that these are mostly pouch, not prismatic cells, it remains to be seen whether they will be able to generate a market. Realistically, it increasingly looks like the US will develop its own ecosystem for lithium-ion batteries, which may very well be independent of that in the rest of the world.

Whichever way we look at it though the US demand base is becoming less relevant to the rest of the world than it has been over recent years.

China: Slower growth in 2026 vs 2025?

2024 was a year of amazing growth in Chinese EV sales and renewables installations and, in January last year, I didn’t see China being able to match those growth rates in 2025.

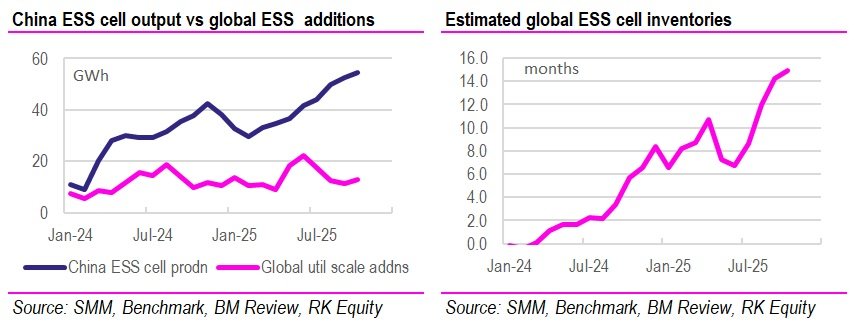

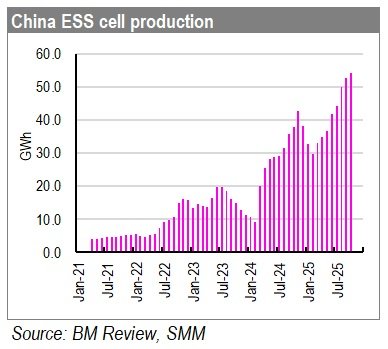

And, indeed, that was very much the case in EVs, in Renewables and in ESS installations. But not in ESS shipments. And I intentionally differentiate there between ESS installations and ESS shipments because, as I flagged in my blog on 22 December 2025, there has been a substantial differentiation between ESS cell shipments and actual installations over the course of the year. To an extent that we’ve never really seen before. And that’s resulted in a substantial inventory build in ESS cells at the consumer level. Which could become relevant, in my view, over the course of 2026.

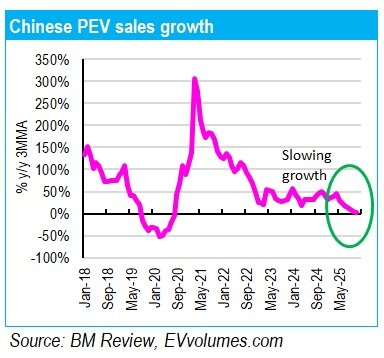

But, anyway, lets focus down a little more. In 2024, Chinese EV sales grew 37% y/y. In January 2025 I forecast +22% for 2025 and current data suggests a growth rate of c.18-20% y/y, which has slowed into the end of the year. And that slowdown has come about because of the withdrawal of the cash for clunkers scheme in some cities and provinces in the second half of the year. Given the focus of the most recent Chinese five-year plan, it seems that the government is happy with the development of the EV industry and it is likely to continue to withdraw subsidy support over coming months, which means that the rate of growth of EV sales could continue to slow.

One unknowable at this point is the nature of EV sales, however. I noted in the December issue of Battery Materials Review how the type of EVs sold in China has changed over the past two years of subsidies. While EVs have been subsidised, many more larger vehicles (with larger batteries) have dominated sales. Will that still be the case as subsidies are withdrawn? Or will the Chinese consumer go back to focusing more on cost, which could see lower-priced vehicles with smaller batteries predominating? I don’t know at this stage, but if consumer behaviour does change, it could potentially mean lower than expected battery demand from EVs in China even if sales nominally hold up.

Let’s talk about ESS in China. It’s been a year of two halves.

In the early part of the year, China actually walked back its ESS subsidies, causing me to lower the quite-bullish ESS forecasts that I started the year with. Then in the latter part of the year, while it was considering its next five-year plan (5YP), the Chinese government re-doubled up on ESS investment and now seems to see it as a core deliverable. And, for the largest ESS market in the world, that’s a positive. Although, with the caveat that inventories are high.

With geopolitical tensions likely to remain high between the US and China, I would expect China to continue to focus on building out domestic renewable power generation (and associated ESS) in order to decrease its reliance on imported fossil fuels. So that has to be supportive for battery demand in China.

The inventory overhang does remain an issue. Will ESS cell inventories hit their breaking point this year and buyers stop buying? I don’t know. But I think the catalyst for ESS cell inventories to hit that breaking point is likely to be around battery prices. And the fact that prices are now starting to creep up thanks to the rise in lithium prices has to raise the risk of a demand correction sometime over the next six to twelve months.

Whatever happens, it’s difficult to see China’s ESS shipments rising at a faster rate in 2026 than in 2025. But given that that’s off a larger base, it’s still likely to be significant in terms of batteries and battery raw materials demand.

Europe: Better than expected 2025. What of ’26?

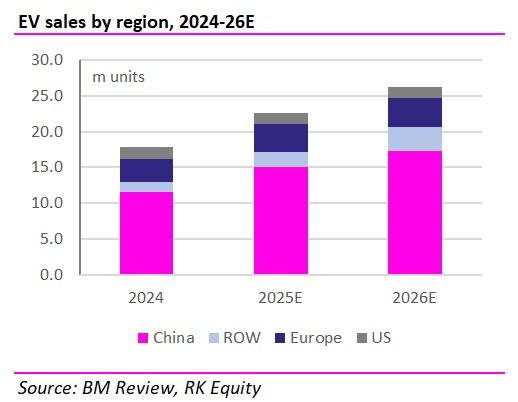

In my January 2025 outlook, I suggested that European EV sales would rise of the order of 5% in 2025. In the end we got a 16% growth rate thanks to some pretty substantial subsidies, the advent of Chinese exports at scale and the new Euro emissions targets but, with the EU stepping back from its zero emissions targets late last year, what does that mean for the 2026 outlook?

Well, I’m not panicking. The EU’s emissions targets were practically unobtainable anyway, so stepping away doesn’t seem (to me) to be as much of an issue as many commentators have suggested. And we continue to see pretty strong consumer support for EVs in Europe, particularly with the advent of a greater number of affordable EV models thanks to Chinese manufacturers.

So I’m going to forecast half the growth rate in 2026, 8% vs the 16% that I’m currently expecting for 2025. That would take European EV sales to over 4m units in 2026, a pretty reasonable total.

The big unknowable is really the ESS market in Europe. There’s lots of excitement about the potential in Europe from Chinese suppliers. When I’ve been to solar and ESS exhibitions this year, ESS has dominated. But we’re still not really seeing the sort of installation growth rates that we were hoping for. Planning timelines remain an issue in Europe. There is demand, but execution remains the bottleneck.

Rest of the World: Driver of 2026 growth

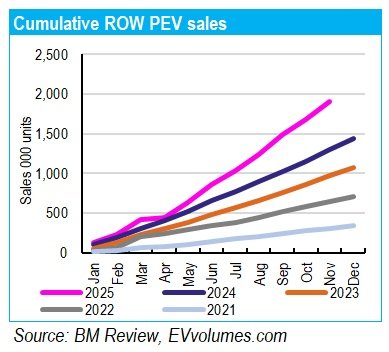

I think it’s fair to say that I was a bit earlier on the potential for world-ex China/US/Europe than many commentators. I first flagged this potential in the BMR Yearbook in February 2024 and ROW has only accelerated since then, initially in EVs but latterly in ESS as well.

ROW is on track to sell over 2m EVs in 2025 and is growing at a 40+% per annum growth rate. And ESS installations are also growing extremely rapidly, buoyed by the Middle East, Latin America and Australia.

And I see ROW as potentially the biggest growth driver of battery demand in 2026. Not in absolute terms. In absolute terms, of course the biggest driver will remain China. But in terms of rate of growth, I would expect ROW to be the fastest growing region and continued growth from these countries should be enough to offset slower growth in Europe and the US over the course of 2026, in my view.

What are my forecasts for EVs and ESS?

Obviously we haven’t got final data for 2025 just yet, but at this stage I have the following forecasts:

- For Passenger EV sales I’m expecting 16% y/y in 2026 vs 27% y/y in 2025. I’m expecting rate of growth in China and Europe to slow and I’m forecasting US EV sales growth to go negative. I’ve also increased my longer term sales growth forecasts because of the slightly slower rate of growth in the near-term.

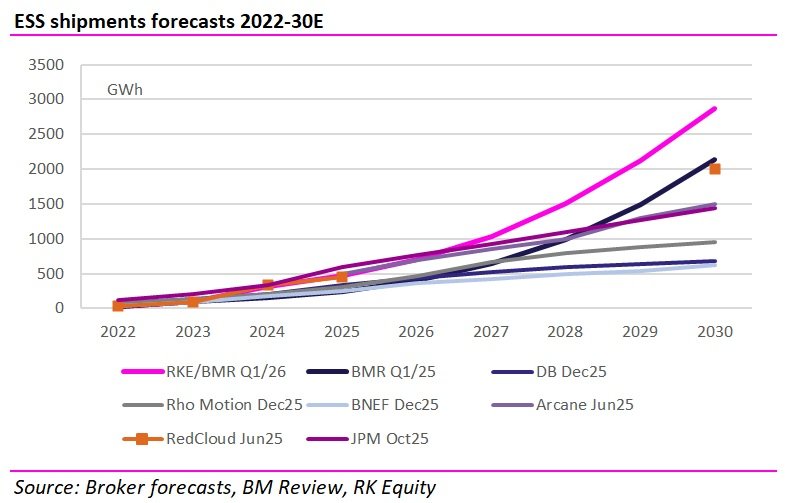

- For ESS shipments I was always more bullish than consensus in the long-term, but I’ve taken my near-term forecasts up considerably…and I’m still more bullish than consensus! I’m forecasting slightly slower growth in shipments for 2026E vs 2025, but still close to 50%. I have to note though that I’m more concerned about downside risks for my ESS forecasts than I am for my EV forecasts.

Lithium: momentum with caveats

OK, let’s start with lithium because it’s the biggest battery material market.

The rapid growth in ESS shipments in 2025 was enough to push the lithium market from surplus into deficit in the second half of the year. It wasn’t a big deficit, but it was certainly enough to light a fire under lithium prices in H2/25.

While I’m pretty positive on ESS in the medium to longer term, I wasn’t as positive on it in the near-term because I was following the installation data not the shipments. But it’s become very clear this year that it’s the shipment data that must be followed to get an idea of battery raw materials demand.

Now I’ve written in my Blog about ESS inventories and I continue to believe that they’re a big risk factor but – the fact is – that demand is going gangbusters and I’d be a fool as an analyst not to react to that. I identify the risk of high ESS cell inventories in the background, but issues haven’t arisen yet and so I’m not going to stand in the way of the current momentum in lithium prices.

My updated supply/demand forecasts for lithium identify a small market deficit in 2026-27E, rising to a substantially larger one in 2028-30E. So there is certainly potential for further momentum in lithium prices, with the caveat that ESS demand may be more elastic to prices than EV demand was. I see potential for a price correction within the next 12-18 months, but I do not have visibility as to when exactly it will be.

What of the long-term deficit in lithium? My current models reflect the supply cuts we’ve seen as a result of the lower price environment. If prices do continue to rise, there is a substantial overhang of supply in Australia, Africa, China as well as new DLE supply potential which could come into the market. Once bitten, twice shy. I expect my supply forecasts for the back end of the decade to increase substantially over the next 6-12 months, which may very well reduce those forecast deficits once again.

Other battery materials: Variable but improving

I have to say that the outlook for other battery materials is more opaque than at any other point in the last six years that I’ve been full time on the sector. Here are some thoughts:

Graphite and AAM: Persistently low oil prices have spelt bad news for natural graphite prices on a global basis by improving the economics for synthetic graphite. We have seen a huge increase in synthetic graphite production out of China, which has allowed it to gain market share in anode materials (AAM). While synthetic graphite is as cheap or cheaper than natural graphite-derived spherical graphite, it’s difficult to see demand for natural graphite materials in anode being strong, which means that low spherical and flake graphite prices are likely to persist. The only factor that could mitigate that would be closures of capacity in China…which seem unlikely currently. US trade barriers may support the development of a US anode material industry and hopefully we should see the emergence of regional prices for graphite, but it could take time for such prices to emerge.

There is an unrecognised geopolitical risk in anode materials. We have seen the Chinese rattle their sabres in REE. They have as much, if not more, control over AAM supply and if they decide to impose export controls on graphite products they could seriously impact the ex-China battery industry. This is still not being factored into company valuations in my view.

High Purity Manganese: While HPM prices have increased from their 2024 lows, they have struggled to make new highs, being some way below the sort of levels reached in 2021. As with graphite there is a big differentiation between the Chinese market, which is oversupplied, and the Western market which remains undersupplied. As with graphite, it would also be great to see the emergence of regional prices but, for the time being, we will likely have to track progress using the China price benchmark. There has been some positive momentum in HPM prices over the past three months and I am hopeful that that may continue into 2026. With high manganese formulations likely to be more important for EVs going forwards, HPM remains an area of focus but, absent a return of prices to 2021 highs, it’s going to be difficult to finance Western project developments. As with graphite, China controls supply in this space and, if it decides to restrict exports, it could severely impact the battery industry.

Cobalt: They say may we live in interesting times! And 2025 definitely recorded interesting times for cobalt! Up until recently everyone’s most hated battery metal, cobalt broke out with a vengeance in 2025. But it didn’t break out on demand fundamentals. Oh no. It broke out because the world’s largest producer, DRC, decided to ban exports. Now, as we move into 2026, the export ban has ended but exports are still set to remain constrained. What will happen to cobalt prices now? Well, I don’t see them going back sub-US$30,000/t but, for me, they’re likely to trade in a range. There’s no getting away from the fact that cobalt demand from cells has been weaker than we would have expected it to be eight years ago, but there is still demand there. Cobalt’s primary drivers are likely to be industrial, however, and with weak global growth and geopolitical concerns, there is the likelihood that demand may remain relatively weak. Cyclicality and volatility may therefore become the norm for this material going forward.

As with all the battery metals, I believe that we’ve put in a bottom for this cycle, but I’m still wary about the upside outlook from here.

Nickel: 2025 was a horrific year for nickel prices but early signs are that 2026 will be better. As with cobalt, it doesn’t look like too much of that is going to be down to demand – more is likely to be due to supply. After huge investment and growth in Chinese nickel production from Indonesia, it finally looks like we will get a slowdown in the rate of growth of supply in 2026. It looks like the Indonesian government is now starting to crack down on environmental violations which could constrain production and it is starting to control issue of mining licences as well. Import of ore from the Philippines drives costs up and has likely put a floor in nickel in terms of prices for now.

Do prices bounce back substantially from here? I don’t know, but I do strongly believe that they won’t go down significantly. The magnitude of any rise in prices will be highly dependent on demand for stainless steel, which doesn’t look enormously strong currently.

What this means for the battery ecosystem in 2026?

While there are a lot of unknowables with regards to the outlook for battery raw materials prices, one thing that seems to come out consistently with regards to all the materials is that we seem to have put a price trough into place in 2025. Prices should move up from here.

How rapidly and how substantially they move up, we don’t know, but it seems clear that mid-2025 represented the trough in battery raw material prices.

That means that the cost of battery manufacturing is likely to rise from here.

Given the advances in manufacturing that have been realised in recent years, it’s difficult to see large enough improvements in the next 12-18 months to offset an across the board rise in raw materials costs. So, all things being equal, the cost of battery manufacturing will also increase in 2026. Which means that the price of batteries will rise as well.

Which takes us onto the next big question – how elastic will battery demand be to increases in battery price?

In the last demand cycle, which was driven by EVs, cell prices nearly doubled before we started to see demand destruction. I believe that ESS will be more price sensitive. That creates the potential for sharp, non-linear corrections – in both commodity prices and equities.

I expect 2026 to be a volatile year. There will be opportunities, but there are also very real risks. Investors will need to focus on fundamentals as well as narratives. RK Equity will continue to explore the dynamics of this new phase for the market in all of its output and I hope you’ll stay tuned to what we produce in 2026!