2025 was quite a year in the battery industry and, while everyone is excited about the potential for ESS demand for batteries and cells, EVs are still the biggest driver of battery demand and that looks set to continue for the next few years. So it’s time for my 2025 review of the year in EVs and some thoughts for what 2026 may hold. Note that when I talk about EVs here, I’m covering passenger cars primarily and not including commercial vehicles. That is a different category altogether.

Let’s start with some headline numbers:

- Global EV sales (BEV+PHEV) were 20.7m units in 2025, up 16% y/y.

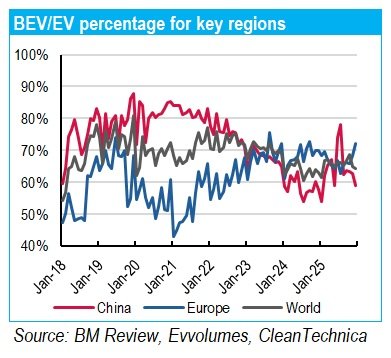

- BEVs were 67% of that total and PHEVs 33%.

- 64% of EVs were sold in China (excluding exported vehicles), 19% in Europe, 10% in World ex-China/Europe/US (ROW) and 7% in the US.

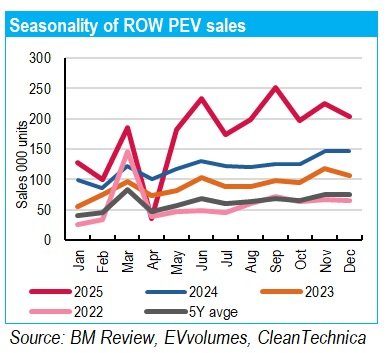

- ROW is the fastest-growing region, with sales up 46% y/y. European sales were up 19% y/y, China-domestic 14% and US down 7%.

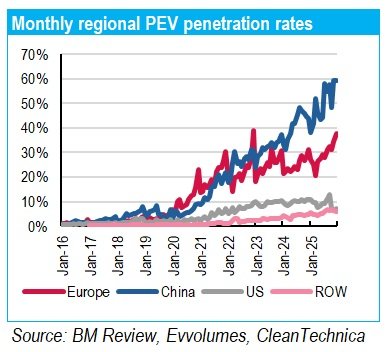

- Global EV penetration was 22% on average for the year, with 49% in China, 29% in Europe, 10% in ROW and 9% in the US.

- On my calculations there are now an estimated 80m EVs on the road globally, which is c.6.7% of the global car fleet.

Just some quick definitions because Howard always says I use too many abbreviations!

BEV = Battery Electric Vehicle; PHEV = Plug-in Hybrid Electric Vehicle; EREV = Extended Range Electric Vehicle; PEV = Plug-in Electric Vehicle; ROW = Rest of the World, ie world-ex-China/Europe/US.

China – slowing sales growth

I’ve flagged several times in the second half of the year the slowdown in Chinese EV sales growth, and it became significant in the last few months of the year. Much of it is likely due to weakness in all car sales in China due to the unwinding of the cash for clunkers programs which have been so successful in catalysing Chinese demand. In H1/25 Chinese passenger car sales were up 13% y/y, in H2/25 they were down 15% y/y.

That trend has been very much carried through into EV markets; in H1/25, EV sales rose 30% y/y in China, in H2/25 they were only up 4%.

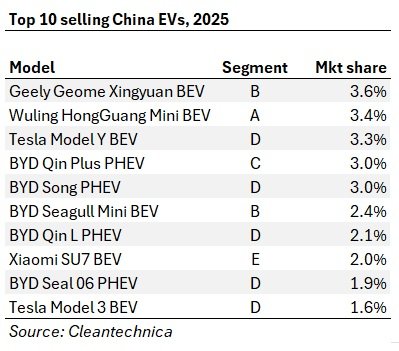

That rate of growth is a concern in the world’s biggest EV market. I can’t say that the signs weren’t there; BYD has reported struggling in the Chinese domestic market for a number of quarters, with most of its growth in 2025 coming from export markets. Interestingly, it seems that EV start-ups are winning substantial market share off incumbents. Realistically though, BYD is here to stay at the top of the pile with the amazing range of its offering beating other manufacturers out. Indeed the top ten selling EVs in China in 2025 boasted five BYD models and the top 20 had eight! BYD’s ability to compete effectively at totally different price points is a major differentiating factor for the manufacturer.

As would be expected in a market like China where new model launches are common, we have a new market leader in 2025, with the Geely Geome Xingyuan. What seems noticeable about the top of the table though is that both of the two best-selling models are small cars and indeed 2025, particularly the latter half, did see small cars having something of a renaissance in the Chinese market.

In my 2026 outlook Blog and in various podcasts I have flagged my view that, with subsidies dropping away in China, small cars might start to regain their market share from the larger vehicles that had started to gain market share in the past two years. Time will tell if this is a real trend or not.

One big loser in 2025 in China seems to be Tesla, which saw its sales decline 5% y/y. The Model Y lost its top place and the Model 3 remained outside the Top 10. It looks increasingly like Tesla has peaked in the Chinese market.

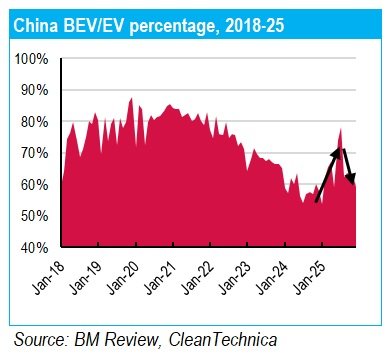

One other factor that’s been very interesting in China in 2025 was the growing BEV share of sales in the first half of the year. Prior to this year, China’s BEV share had been decreasing steadily since 2021 as PHEVs and EREVs gained market share, but all that changed as H1/25 saw a substantial increase in the number of BEVs sold relative to PHEVs.

Given the fall in the second half of the year though I’m hypothesising that, like a lot of things in China’s EV market in 2024-25, the increase in BEV sales is more down to the subsidy program than a change in consumer behaviour. Now that the subsidy program seems to be being rolled back, will we see PHEVs and EREVs gain market share again? I think there’s a good chance of that happening.

ROW: Fastest-growing region

Well, in my 2025 outlook piece at the start of last year I suggested that ROW could be a larger EV market than the US at the end of the year. And it managed it handily, with 2.1m units sold in 2025 vs 1.5m in the US.

The growth of ROW in recent years has been substantial, but it has accelerated in 2025 as exports from China have appeared in such disparate markets as Australia, Brazil, Mexico, Russia and UAE.

What’s so attractive about Chinese EVs? Just what we’ve already seen in other markets: there’s a good range of products available – from ultra premium to affordable, there’s PHEVs in case infrastructure isn’t viable for roadside charging, and they’re generally a good product. And consumers in many countries are falling in love with EVs. And unlike in China, Europe and the US, it looks like affordable EVs are going in with the first wave, which makes the potential for EVs to hit mass market in many countries more viable much sooner in their adoption pathway.

While the Tesla Model Y is a good competitor, Tesla is not present in many markets where Chinese EVs are taking off. The BYD Song and Dolphin fly the flag for BYD and the Wuling Hongguang Mini does suprisingly well too. The VinFast VF3 gets an honorable mention as well.

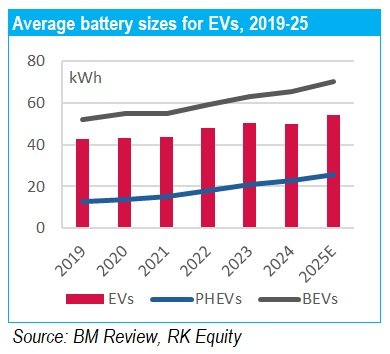

With the dominance of Chinese vehicles, plus the fact that Chinese manufacturers are investing in not only overseas capacity but also in shipping capacity, it seems likely that Chinese models will continue to dominate in ROW going forward, which probably means smaller batteries will predominate vs average battery sizes in the US and European markets.

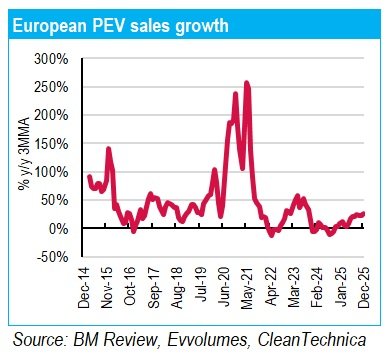

Europe: Great 2025

The world’s second-largest EV market had a great year in 2025, growing 19% y/y, which compared favourably with its 1% growth rate in 2024, after a number of countries withdrew their subsidies. Subsidies again were important, with this market not quite boasting enough affordable EVs to reach mass market quite yet.

But one of the big developments was the launch of more affordable models into the European market this year. The B segment Renault 5/Alpine was a new entrant in the top ten and joined the C segment Skoda Elroq in the top three. Last year’s top three were all D segment vehicles.

Notably, Europe’s EV penetration rate increased substantially over the course of 2025, from 27% in January to 38% in December. Overall European car sales were up as well, so it wasn’t a lower base effect and was more likely also a feature of the takeoff in affordable model sales.

Whether Europe can keep this sort of momentum into 2026 remains to be seen. In my forecast I’m expecting growth rates to slow; the removal of the EU’s zero emissions target late in 2025 sends mixed messages and there could very well be fewer subsidies around in 2026. Nevertheless, I still expect Europe to put in a good showing in 2026.

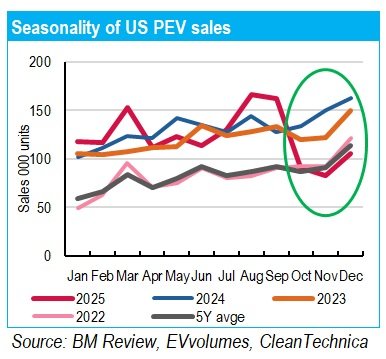

US: Negative growth in 2025

It’s fair to say that I (along with most commentators) thought that, given the Trump Administration’s stance on EVs, US EV sales growth would be negative in 2025. The major surprise was actually that they stayed in the black for as long as they did, before nosing over in the fourth quarter.

In fact, if one looks at seasonality, the collapse in sales took monthly sales down to a similar level to 2022 levels. In 2022, the US sold just over a million EVs, vs 1.5m in 2025. So, is that level what we should be looking for? That’s a 30% drop in US EV sales, so it’s quite a substantial reduction. That’s more of a drop than I have in my 2026 forecast. The reason for this is that, speaking to most commentators in the US, they believe that the Trump Administration is softening on its stance on EVs and the situation may not be as bad as expected. Time will tell.

One of the reasons why the US EV market is so susceptible to the removal of the tax credit is because, in the absence of Chinese vehicles in the US market, there are precious few (if any) affordable EVs on sale. While vehicles in the US are, on average, bigger anyway than vehicles in the rest of the world, mass market vehicle sizes in the US are still smaller and cheaper than premium models, but there just aren’t very many of these in EVs. Hence, even though US light vehicle sales eked out a small y/y rise in 2025, EV sales fell.

I don’t really see this changing any time soon, with tariffs likely to further impact non-US brand penetration into the US.

Key questions for 2026

Can EVs come back into vogue with the Trump Administration?

Well, never say never but it’s not looking great just now. Many US EV bulls suggest that the Administration is softening its stance on EVs and, of course, if the President does change his mind, then the chances are that he will act quickly! I’m hoping that volumes will improve slightly off Q4/25 levels, but I’m really not expecting great things from the US in 2026.

Will the slowdown in Chinese EV sales growth be prolonged or will the government re-stimulate demand?

Chinese domestic EV sales actually went negative growth in the final two months of 2025, marking quite a substantial slowdown, as a number of regional cash for clunkers schemes were withdrawn. There are a lot of factors at play in China at the moment, not least the government’s anti-involution drive, which is likely to end the price wars that have dominated the EV market in recent years. With raw material prices rising over the past six months, there’s a good likelihood that that will be passed onto EV manufacturers (we’re already seeing cell prices rising) and thence to consumers.

After two years of increased market share in the D and E segments (medium and large vehicles), I think it’s likely that Chinese consumers will start to re-orient back to the A, B and C segments (small and medium vehicles) going forward if car prices rise, which would mean on average smaller battery size vehicles (even though, as I noted in my 2026 Outlook, individual models are seeing battery sizes increase).

Will the Chinese stimulate again? Well, their recent focus has been more on the ESS industry and there is the perception that, with EVs now mass market in China, the government is happy to let the industry govern itself. Having said that, the auto sector is c.8-10% of China’s GDP and it is starting to shrink. In an environment where exports are under the cosh, will the government be happy to let a key domestic consumption sector contract? My gut feeling is that they may well stimulate in the sector, but it could take a while to come through.

Can growth in Europe and ROW offset shrinkage in the US and slower sales growth in China?

I’m forecasting a marginally lower rate of EV sales growth in 2026, but still positive sales growth. That means c.15% EV sales growth and c.14% battery demand growth, which is roughly in line with 2025 levels. Given that we’d already seen a slowdown in growth rates in China and the US in the latter part of the year, some of that is incorporated.

So, realistically, yes – I do think that strong sales in ROW and Europe may be enough to offset slower sales growth in China.

What’s happening with PHEV shares and battery sizes?

There’s a lot of variability between regions but, on average, we’ve seen BEVs gain market share in 2025, after PHEVs gained market share in 2023 and 2024. If battery prices rise this year, it’s possible that we will see PHEVs taking more market share if consumers become elastic to higher prices. This will be particularly important in the Chinese market, in my view.

With respect to average global battery sizes, November year to date the average global EV battery size is just over 55kWh, a substantial increase from the c.50kWh seen in 2024. My gut feeling is that, for the reasons I’ve mentioned above with regards to China subsidies and growth of market shares of Chinese EV producers in ROW, as well as the increasing market share of PHEVs, the increase in battery size for 2026 will be substantially more muted, although I still do forecast a small increase.

Are EVs still important?

While ESS demand for batteries is growing very rapidly, on my numbers, EVs will still contribute 56% of global battery demand in 2026 and, while I expect that market share to decrease in coming years, it’s still significant.

In lithium market terms I see EVs as 53% of total lithium demand in 2026 vs 56% in 2025. And the growth in the EV market will still contribute an additional 100Kt of demand in 2026, which is a substantial amount.

So, yes. In my view it’s still very important to understand what the trends are in the EV market.