With the changes to the Chinese export licencing regulations, the drop in Chinese exports and the resulting shortage of Rare Earths (REEs) in Western markets, and the US government’s deal with MP Materials, the Rare Earth mining sector has been thrust back into view in recent months.

Outside China there are two listed REE miners with integrated and semi-integrated production and one processor, but the rest of the space is development stocks.

But how, as a non-specialist investor, would you be able to evaluate one development stock vs another? This article is intended as a primer to help non-specialists understand what’s important when valuing REE projects and companies.

Why REE deposits are so complex

If I’m trying to value a copper company it’s pretty easy. I can calculate a multiple based on how much copper a company intends to produce or how much contained copper resource it has in the ground.

But is it that easy? Because, in fact, most copper orebodies come with by products. So if I just look at EV/contained copper resource, I may be understating the value of what a particular company has in the ground.

And in fact I, as an analyst, will always look at EV/contained copper-equivalent resource, because often gold, molybdenum, silver, cobalt, etc credits can be very relevant to the valuation of a company.

Well REEs are a little like that. Just more so!

Why? Because individual Rare Earth elements don’t ever occur on their own. Each Rare Earth bearing mineral will have a different assemblage of elements according to the structural, thermal and chemical controls of its formation. Which means that each different orebody will have a different assemblage of Rare Earth elements.

What are the Rare Earth Elements?

Unfortunately this is also a difficult question because different developers (and commentators) often have different definitions of what constitutes a rare earth element.

But, in general, when someone refers to Rare Earth Elements, they’re referring to the 15 elements described as lanthanides in the Periodic Table

However, because of the way that the elements occur, some people often add Yttrium (chemical symbol: Y) to the list and sometimes some people include Niobium (chemical symbol: Nb) and Scandium (chemical symbol: Sc) although in my view they have no business being included as a REE!

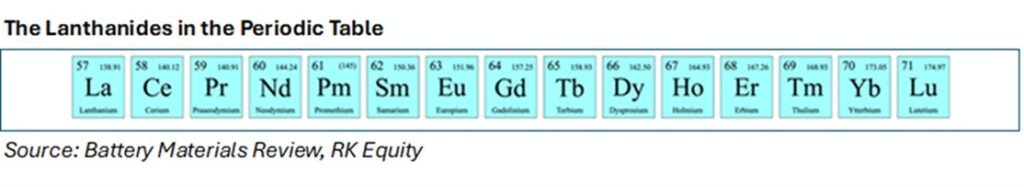

Increasingly in recent years, investors and commentators have further split up the REEs into other sub-segments:

- Heavy REEs

- Light REEs

- Magnet REEs

Heavy rare earths are so-called because they have higher atomic weights vs the “light” rare earths. They generally occur at lower grades in nature than the LREEs but several of them have developed major markets, particularly in defence applications, in recent years. Some of them are also used in magnets. Dysprosium, Yttrium and Terbium are considered important for Energy Transition applications.

Light rare earths used to be the main focus of the industry, with cerium and lanthanum key elements during the 1990s but, over time, focus has shifted to Neodymium and Praseodymium which are both used in rare earth magnet applications.

Magnet rare earths (often MREE or MREO) are the subset of REEs which contains those elements used in magnets. Key applications of rare earth or permanent magnets include EVs, wind turbines, defence, robots and drones, as well as consumer electronics (smartphones, headphones, disk drives).

I’m not going to get into the properties of the REEs here. There are any number of excellent reports in the market which detail that, their primary markets and the growth rates of those markets. I’ve only covered this, because the make-up of the REE basket is key to understanding the worth of a particular deposit.

REO vs REE

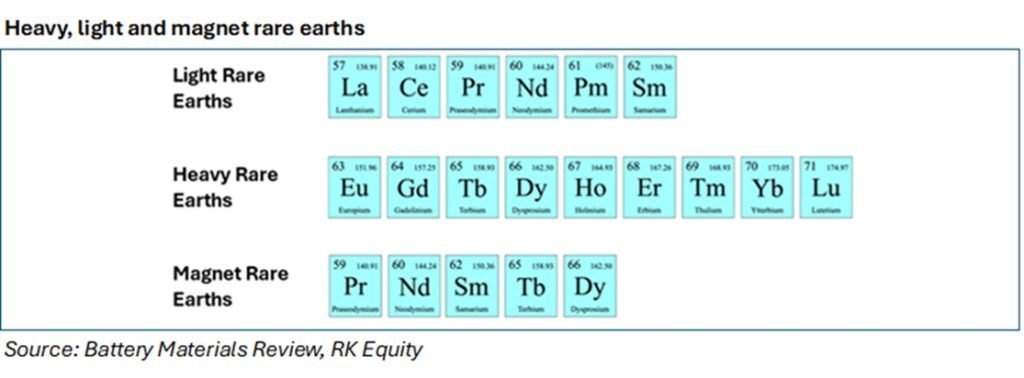

Before we move on, I just want to explain some nomenclature. Above, you will have seen me referring to rare earths, rare earth elements or REE pretty interchangeably.

Many people in the mining industry also refer to REO. REO stands for Rare Earth Oxide and you will find most in situ grades in resource and reserve reports given in REO terms.

Now, while we often use REE and REO interchangeably when we talk about rare earths, it’s a little bit of a misnomer because one tonne of REE DOES NOT EQUAL one tonne of REO.

In fact one often has to convert between REE and REO when doing valuation calculations and it can be quite a substantial difference. For instance the conversion factor between Nd and Nd2O3 is 1.1664. The table adjacent contains a list of conversion factors from metal to oxide.

How to value early-stage mining assets

If a company/stock is in production or close to that, I can use a DCF based on the production and costs forecast in the company’s scoping or feasibility studies. I then look at the current share price as a multiple of the NPV (Net Present Value) or NAV (Net Asset Value; the project value(s) less any debt) for the stock.

But a lot of the stocks we look at might not have a completed evaluation study. Over the course of my career I’ve found the EV/contained resource or Market capitalisation/contained resource metric to be the most effective for comparing early stage and later stage projects.

Close to production or in-production projects will trade at a material valuation premium to early-stage projects but if one compares enough projects then you can get an idea for which stocks look cheap and expensive at different stages of development, in my view.

Just a quick word about the difference between enterprise value (EV) and market capitalisation. For stocks, the EV equals the market capitalisation plus net debt. For development players some analysts like to also include development capex. That obviously pushes the EV up and makes the stock look more expensive, but does give you a view of the in-production EV. This is important because – surprise, surprise – it costs money to build projects. To raise that money, companies will need to dilute by issuing equity or take on debt. Including the pre-production capex allows analysts to factor in the impact of raising money on the valuation of a stock.

But again, when covering very early-stage stocks, there may not be capex forecasts, so I find that market capitalisation/contained resource gives a reasonable, although not all-singing/all-dancing comparison.

Why TREO is a lousy valuation metric

You get a lot of people looking into the Rare Earth industry from outside who are like “Oh, that’s fine, I’ll look at mkt cap/TREO” (TREO: Total Rare Earth Oxide). But, in my view, that’s a disaster waiting to happen. For a number of reasons:

- As I referred to above, one company’s definition of elements contained in TREO may not be the same as another company’s, so straight away if you calculate a contained resource using a specific company’s in-situ TREO definition and compare it with another company, then you may not be comparing apples with apples.

- The second issue is a little bit more complex and gets to the crux of the matter. As I also hinted at above, one orebody’s rare earth assemblage is likely to be very different from another’s. This can be true even in the same province.

Coming back to the point in part 2 – if two companies have 4% TREO but one company has 3.8% La/Ce and 0.2% NdPr while one company has 3.0% La/Ce, 0.7% NdPr and the balance in HREEs then the value of their deposits is going to be very different. Why? Because the value of the different elements is very different.

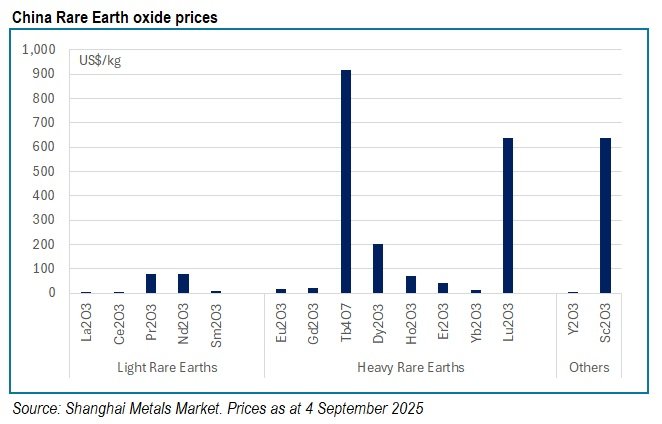

The chart above shows the substantial difference between the selling prices of the most common rare earth oxides. In a perfect world, a company would want a REE deposit made up of HREEs and Scandium. Unfortunately such deposits don’t exist in nature and typically cerium and lanthanum are the most commonly-occurring REEs.

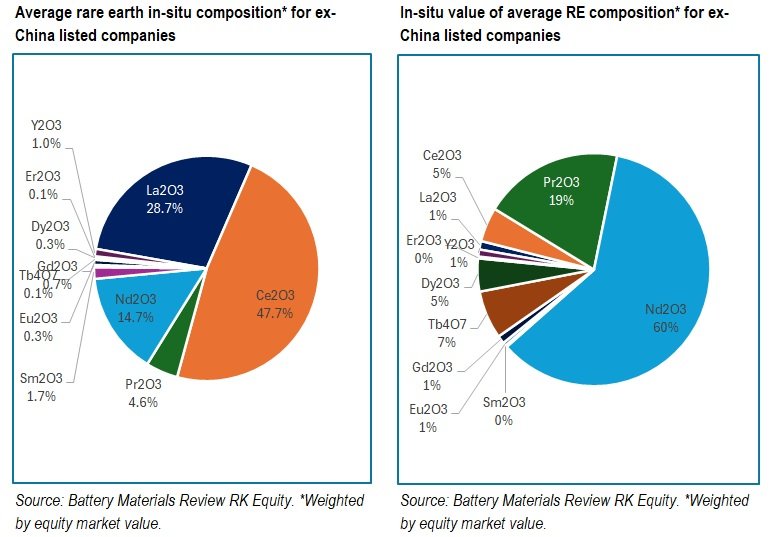

An analysis of the 30 REE developers and producers included in RK Equity/Battery Materials Review’s REE valuation tables yields an average in situ composition for all of the deposits included in the comparison in which La is 28% of the average composition and Ce 47%. HREEs comprise less than 2% of the in situ grade.

All this means that, while LREEs are a substantial proportion of the in-situ grade of a deposit, they are a relatively small part of the in-situ value of the deposit. In the chart below we’ve used the average basket we’ve calculated, and the prices we gave above, to illustrate the difference between the weighting of the in situ mineral assemblage and the in situ value of a deposit.

You can see that in the mineral assemblage, Ce and La dominate, but in the value calculation, Nd and Pr dominate, while Dy and Tb also contribute more to the value than either Ce or La do.

So, given that, one can understand that TREO % based on in-situ grades potentially totally misvalues a project.

Using NdPr and NdPr-equivalent to value REE projects

So, if we can’t use TREO grades, what can we use? Well, the issue with using TREO grades is that it overstates the value of Ce and La in a deposit. What we need to do is value a deposit according to the value of the most economically attractive elements.

As one can see from the charts above, the elements that contribute the most to the economics of an average REE deposit are Neodymium (Nd) and Praseodymium (Pr), known collectively as NdPr.

Now one could calculate a valuation for a deposit based just on the NdPr grade and hence the contained NdPr in situ. That is something that many analysts do, and it does focus on the most economically attractive parts of many deposits, particularly hard rock deposits which may be enriched in LREEs.

But…it also understates the true value of the deposit in my view, particularly if there are high concentrations of other elements such as Dy, Tb, etc which are economically significant.

So what we do in Battery Materials Review is that we calculate an NdPr-equivalent (NdPr-equiv) in situ grade. What on Earth is that? I hear you ask.

Well, it’s basically a method of using the prices of other rare earth metals or oxides and their occurrence in a deposit to calculate a factor which can then be applied to the in-situ grade to tell you what that equates to in NdPr terms.

So, for instance, if the price of NdPr oxide is US$50/kg and the price of Tb4O7 is US$1000/kg then each percentage point of Tb4O7 is worth 20x its in situ level. So if I had 0.001% (10ppm) Tb4O7 then its NdPr equivalent grade would be [20x10ppm=200ppm or 0.02%]. If I do that for the whole REE basket in the in-situ resource of the deposit then I can calculate an NdPr equivalent grade for the whole deposit. I generally leave out Ce and La in my calculations because they’re practically worthless but are often present in such significant levels that they can highly skew the calculation.

That’s helpful for me to benchmark one deposit against another one and it’s also helpful for me in being able to compare apples with apples in a valuation comparison.

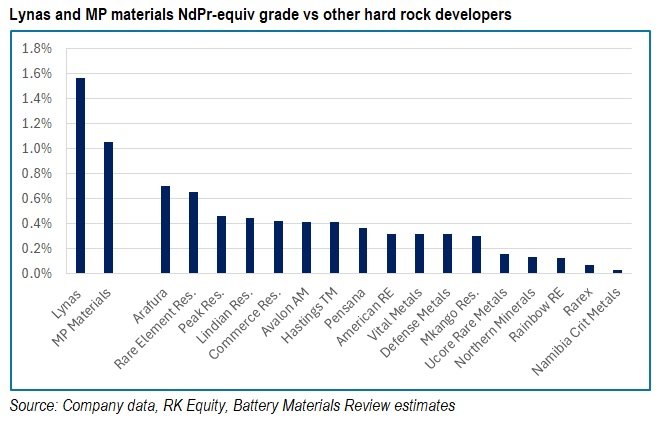

So, for instance, Lynas Corp’s Mt Weld REE mine has an in-situ resource grade of NdPr oxide of 1.50% and an NdPr equivalent grade of 1.56%. The difference may seem relatively small, but it is relevant for valuation purposes.

There is a reason why Lynas Corp’s Mt Weld mine in Australia and MP Materials’ Mountain Pass mine in California are in production when so many other seemingly-promising projects aren’t. When one looks on an NdPr equivalent basis it’s easy to understand why those mines are in production – it’s because they have NdPr equivalent grades which are materially above other hard rock projects in the world.

Disclosure is key

There is one important caveat here. Some companies do not release the full suite of in situ grades. While, for many years it has been best practice to do so, some newcomers to the sector have not done so, choosing only to release NdPr grades or MEO grades or in some cases TREO grades. That makes it impossible to calculate a valuation using this methodology.

What should you do if the company you’re looking at hasn’t disclosed the full suite of grades? Well, I can only speak for myself – but I would avoid it. If a company hasn’t published the full suite of grades, it could mean that it hasn’t fully evaluated or tested the orebody or it could mean it’s hiding something. Both are a black mark from the point of view of an analyst or investor.

In-situ not basket composition

It’s absolutely vital to make sure when you do this calculation that you’re using the in-situ grades of the orebody and not the breakdown of the concentrate or product basket. Some companies will let you know what the breakdown is of REEs or REOs in the product that comes out of their processing flowsheet. This might be enriched in more economically important materials and hence shouldn’t be used for this type of analysis.

Why clay projects are a growing subset of ex-China REE projects

When we look at rare earth projects globally we find a problem. While there are two REE mines in production outside China, the mineral assemblages of development projects and prevailing market prices for rare earth metals have made it practically impossible to get new projects off the ground in recent years. That’s because, up until recently, a large proportion of the REE projects under evaluation were hard rock projects. Let’s just recap the three different types of rare earth projects, so you understand what I’m talking about:

- Hard rock or primary projects. These are projects based on enriched granite or, more commonly, a rare type of igneous rock called carbonatite. The two operating ex-China projects, Mt Weld and Mountain Pass, are both hard rock projects. The problem with hard rock projects is that they are normally enriched in LREEs.

- Heavy mineral sand projects. Increasingly in recent years mineral sands producers have been realising that these deposits also have a portion of REE minerals within them. One of the fastest-growing supply segments in the REE industry has been the processing of heavy mineral concentrate derived from mineral sands operations. However, once again, these concentrates tend to be LREE-enriched. And there is often another issue with them as well – they can be highly enriched in the radioactive elements, uranium and thorium, which can present issues in transportation as well as in processing.

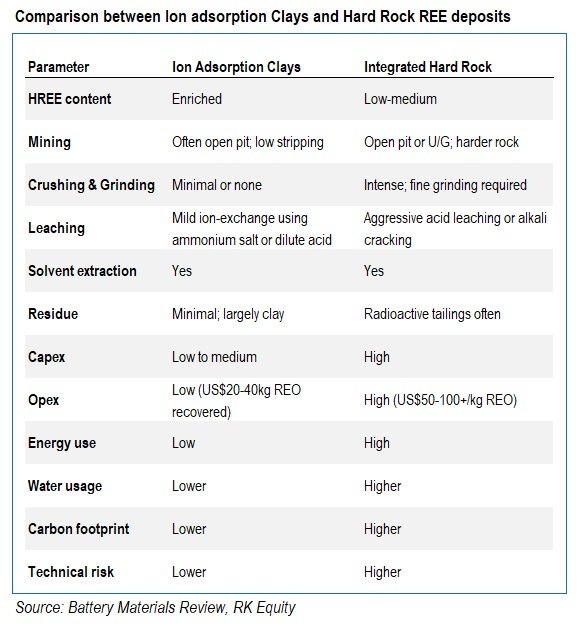

- Ion adsorption clay projects. When most people think of environmentally unsound REE projects in China, they’re thinking of ion adsorption clay projects. China has clamped down on some of the hideous environmental practices of yesteryear but the stigma remains. The attraction of these clay projects is that: (1) They are enriched in heavy rare earth; and (2) They are near-surface, soft and free diggable, meaning relatively low capex and opex. On the flip side, they tend to have much lower REE grades than in hard rock (1000-2000ppm vs 1-10%) but that is offset by lower operating costs.

If I look at current hard rock projects under development, their NdPr equivalent grades come nowhere near the NdPr equivalent levels of the two mines in production. In addition, to develop most large-scale hard rock projects, you’re talking a substantial capital cost and relatively high opex as well. And, the REE basket that the mine is producing will include a lot of low-demand materials. As a result, there has been a considerable focus in the last 2-3 years in exploring and evaluating ion adsorption clay projects, of which there are some in parts of Africa and Brazil and other projects being evaluated for ion adsorption clay characteristics in Australia.

In situ grades for ion adsorption clays vs hard rock

We talked about your average Hard Rock REE development project having an average NdPr-equiv grade of 0.33% vs the NdPr-equiv grades of Mountain Pass and Mount Weld at 1.05% and 1.56% respectively.

We also talked about the enrichment of HREEs in ion adsorption clay projects. So that probably pushes up the NdPr-equiv grades of clay projects, doesn’t it?

Well, not really. The average NdPr-equiv grade for clay projects in our valuation is 300ppm or 0.03%.

WHAT?!!! I hear you shout. That’s tiny!

And, indeed, it is much lower than for most hard rock projects. But, as you can see from the table above, mining and concentrating costs and capex are much lower as well. And, in many cases, that is enough to offset the much lower grades.

Now realistically, for development purposes, we’re probably looking for in-situ NdPr-equiv grades of 400ppm or more, but so much is impacted by opex and recovery of rare earths, that it’s difficult to say for sure if a project had too low a grade.

The juxtaposition between grade and costs

Or – why are grades so important?

Because of the nature of the Rare Earth industry, where China controls a substantial percentage of production and has done for many years, profitability will be key for new Rare Earth development projects. You just have to look at the NdPr price over time to understand that. While there have been short periods where prices have broken out strongly, these have been dominated by extended periods of very weak pricing.

As the West seeks to build up its own Rare Earth industry, it’s going to be important that only operations which can make money through the whole cycle get financed. The juxtaposition therefore between grade, capex and opex will be key.

Capex needs to be low enough to be easily financed by smaller companies, with grade high enough that opex is kept low enough to be cash flow positive throughout the cycle.

Investors will need to be very clear that the stock that they are investing in has a high enough NdPr grade to justify investment, that capex is low enough that it is digestible by the company and that opex will keep the wolf from the door though the cycle.

Some things to look out for when evaluating REE projects

Uranium/Thorium grades

One of the most important things to look out for when evaluating a Rare Earth project is the Uranium/Thorium (U/Th) grade in the concentrate. A concentrate with a U/Th grade that’s too high will struggle to be transported to some countries. For instance, Australia restricts exports of ores and concentrates with greater than 500ppm (0.05%) total U+Th and US needs licences for products with grades greater than 0.25% U+Th. Generally if a concentrate grades greater than 0.1% U+Th and has an activity level of more than 10Bq/g (becquerels per gram) then it’s classified as Class 7 (radioactive) under IAEA rules and needs to be treated as a dangerous good.

There are also implications for storage of radioactive material at a concentrating or processing site which require specific management. While most REE ores do contain U/Th to some extent, investors should make sure that company management teams are all over the implications of U/Th grades and have tested concentrate grades to make sure they are compliant.

Not all clays are ion adsorption clays

As ion adsorption clays become more and more important in REE exploration, it’s really important that investors understand that not all clays are ion adsorption clays.

Clays can host rare earth elements in three different ways:

- Bound in mineral lattices

- In associated heavy minerals

- Adsorbed on surfaces

Of the three occurrences above, the first two are difficult to extract. Only REEs that are adsorbed onto the surfaces are easier to extract.

Ion adsorption clays are a specific subtype of clay which occur mostly in weathered granites and where the REEs are loosely held (adsorbed) onto the surface of clay particles via electrostatic forces. As a result they are easily extractable using weak salt solutions like ammonium sulphate or chloride, or via ion exchange, without complex chemical treatments like the aggressive acid leaching or alkali cracking which are needed for hard rock extraction.

Some final words

So I hope you enjoyed this article and found it useful. A few caveats. I’ve focused in this piece on technical aspects of the deposit. There are also additional factors that investors need to understand when evaluating a company to invest in:

- Whether you believe in the management team is a key consideration and for me a determinant at least as important as the technical aspects of the orebody.

- What the stock is valued at. It could be that you’re too late on a particular stock and the rest of the market got there before you. If the valuation looks unjustifiably high, it’s time to head onto the next commodity or the next stock. Or wait for the valuation to come down again.

- Similarly, if the valuation looks unjustifiably low (in a hot sector), you gotta wonder why the market isn’t getting it? Often it comes back to the management team again. Are they marketing the stock enough? It can be other causes as well. You may want to do a deeper dive and ask around. What aren’t people seeing that you are? Or what are they seeing that you aren’t?

Always do your own research on a stock you want to buy or sell. Don’t rely on what the herd is doing because often they’re wrong.

Good luck!