In Part 1 of this Series I explained why I think current solar installation forecasts from big groups like IEA and BNEF are overly conservative. I flagged how these forecasts being overly conservative don’t just impact the solar industry but other industries as well. Metals industries are highly-leveraged to demand from the solar industry and two of the mainstream metals that are most exposed growth in that demand are Copper and Aluminium.

In the previous Blog I described four scenarios for solar installations over the next 10 years. They were:

- Ultra-Conservative Scenario (UCS): 8.1% per annum – that’s what all the “experts” suggest, but I think they’re way out of the money.

- Base-Case Scenario (BCS): Let’s say 15% per annum between 2025-35E. That’s double the consensus growth rate but half the 10-year growth rate.

- Optimistic Scenario (OS): Let’s make this 20% per annum between 2025-35E. That’s pretty racey for a 10-year period, but it’s not outside the realms of possibility given the magnitude of what needs to be done.

- Uber-Optimistic Scenario (UOS): I’m going for 30% per annum for the 2025-35E period. That’s still below the average growth rate for the past 5 years, but in line with what we’ve seen over the past 10 years.

Now it’s time to apply those forecasts for solar installations to demand for materials and I’m gonna start with Copper and Aluminium.

Copper and Aluminium usage in Solar

The point about the build out in Renewables capacity is that by their very nature Renewable Energy technologies are substantially more materials-intensive than the technologies that they’re replacing.

A standard CCGT power station can be built pretty close to the demand centre that it’s supplying, but most renewables plants have to go where the resource is. While this is slightly more of an issue for wind (particularly offshore), it is an issue for solar as well because of the land area required.

The average land area for a 1GW CCGT power station is 10-25 acres (4-10 hectares). For a 1GW solar PV plant, we’re talking a land requirement of 5-10,000 acres or 2-4,000 hectares. That’s several orders of magnitude larger, and means that solar plants typically have to be sited considerably further away from the demand centres that they’re supplying, with commensurate impacts on cabling demand. And cabling is copper and aluminium intensive.

In addition, it’s not well known, but aluminium is also used in solar for mounting frames and mounting structures. The fact that it is so much lighter than steel but still strong makes it attractive for these applications.

So the average copper and aluminium usage per MW of solar PV can be:

- 2.4-3.0 tonnes of copper for cabling, inverters, transformers

- 4.0-5.0 tonnes of aluminium for module frames, mounting structures, cabling

Could lack of copper hold back solar growth?

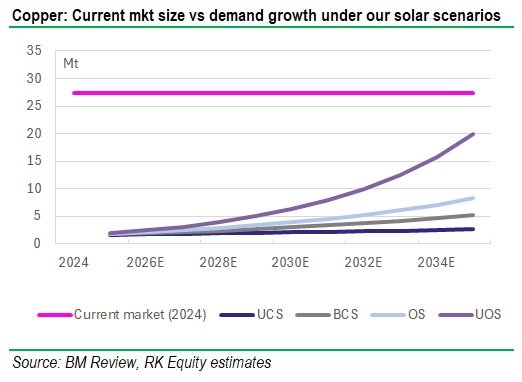

Using the assumptions above, we can therefore calculate and illustrate how much copper will be needed to support solar installations under my various scenarios:

- Under our UOS, solar would utilise 73% of the current market size for copper by 2035. Given the stress that that would put on the copper industry, one does wonder whether it may be availability (and price) of copper in particular and metals in general that limits global solar installations going forward?

- Under our BCS, solar demand would still be 19% of the current copper market size in 2035 and under our OS it would be 30%. Even these numbers look extreme in the context of the copper mining industry’s current travails when it comes to adding new capacity.

How viable is it going to be for the copper mining industry to add 30% of additional supply over the next 10 years just for solar, and excluding all of the other markets which will also presumably grow? That is the key question.

Given the industry’s struggle to add new capacity, it’s likely that we’re going to need even higher copper prices to incentivise enough new supply to support the solar roll out globally over the next ten years.

Copper is in a difficult position at the moment because global macro headwinds are holding it back in the near-term, although it looks very interesting in the long run because of a failure to add new supply.

Aluminium demand will benefit from solar

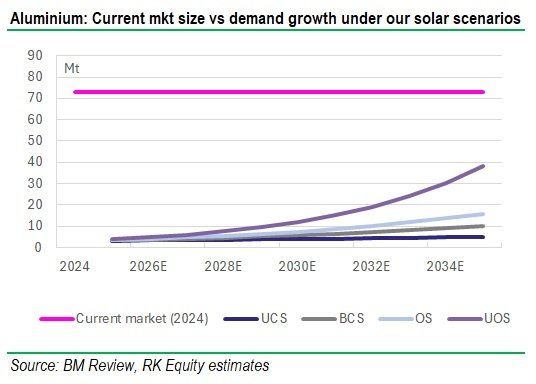

While the situation for Aluminium doesn’t look quite so tight as for copper, the solar industry is still set to be a major consumer of aluminium in coming years. And, given the points I already made in a recent Blog article about the slowdown in growth of aluminium supply, that could put further stress on the industry.

- Under my Base Case assumption, 2035E aluminium demand from solar would be 14% of the current market size.

- Under my Optimistic Scenario, 2035E demand would be 22% of current market.

- Under my Uber-Optimistic scenario, 2035E demand would be 53% of the current market size.

- Under my Uber-Conservative scenario, it would be only 7%

While these demand assumptions are somewhat less impactful than for the copper market, in the context of an aluminium market where demand growth has been weaker and supply growth seems to be struggling in the near-term, they could actually end up being just as important. Something that investors clearly don’t realise at the moment.

The danger of underestimating solar growth

We think that the two most-realistic scenarios in our analysis are the BCS and the OS. For copper, that would result in a 19% and 30% increase in demand from the 2024 market size and for aluminium, it would represent a 14% and 22% increase over the current market size.

Those increases are not to be sniffed at, especially considering other contributors to copper and aluminium demand growth, both related to and unrelated to the Energy Transition.

Another way of looking at it is the incremental growth that solar could add. If we look at the difference in demand growth between our OCS (ie consensus) for solar installations and our OS, it amounts to one whole percentage point per year in additional demand growth on an annual basis between 2025 and 2035 for both aluminium and copper. And, in a supply-constrained world where both industries are struggling just to match current demand growth, that’s a big issue.

the difference in demand growth between consensus for solar installations and our OS amounts to one whole percentage point above forecast demand growth. That’s a big gap for the mining industry to fill…

Under both scenarios I would expect to see the supply/demand balance being highly stressed and both copper and aluminium prices increasing substantially.

While thrifting and substitution are possible in both commodities (and indeed if copper prices go too high, cabling and wiring applications could both switch to aluminium) the likelihood remains that we are looking at a period of supernormal demand growth here and you would never be able to tell it based on consensus solar installation forecasts.

Mining is an industry where new projects take in the order of 5-15 years to develop and build, so it’s not going to be possible to simply flick a switch in 2030 and large amounts of new copper and aluminium capacity will come to the market. Indeed, projects that could start up around 2030 are probably undergoing Feasibility Studies now. And we know of precious few of those in either commodity.

Which means that we’re likely to see an undersupply in both copper and aluminium in the medium to longer term. And, while that will be good for commodity prices, it’s likely to stress the solar industry and other users of these commodities.