Who will be the winners and losers from the Age of Electricity (AoE)?

Many investors believe that the AoE supercycle, like the fixed asset investment-led China supercycle event at the start of this century, is going to be positive for all metallic commodities. I disagree.

Calling the AoE supercycle a fixed asset investment event does it a disservice in my view. The new supercycle is as much about developing technologies as it is about fixed assets. Sure, there are elements of the AoE event that are related to fixed assets, like the build out in wind, solar and nuclear power generating infrastructure and transmission and distribution lines to support these. But a more significant component of the Age of Electricity is the substitution of hydrocarbon demand in transport for electricity in the form of batteries. It also involves embracing renewables as never before, and pushing the envelope in new technologies to ensure we can attain all the milestones that we need to.

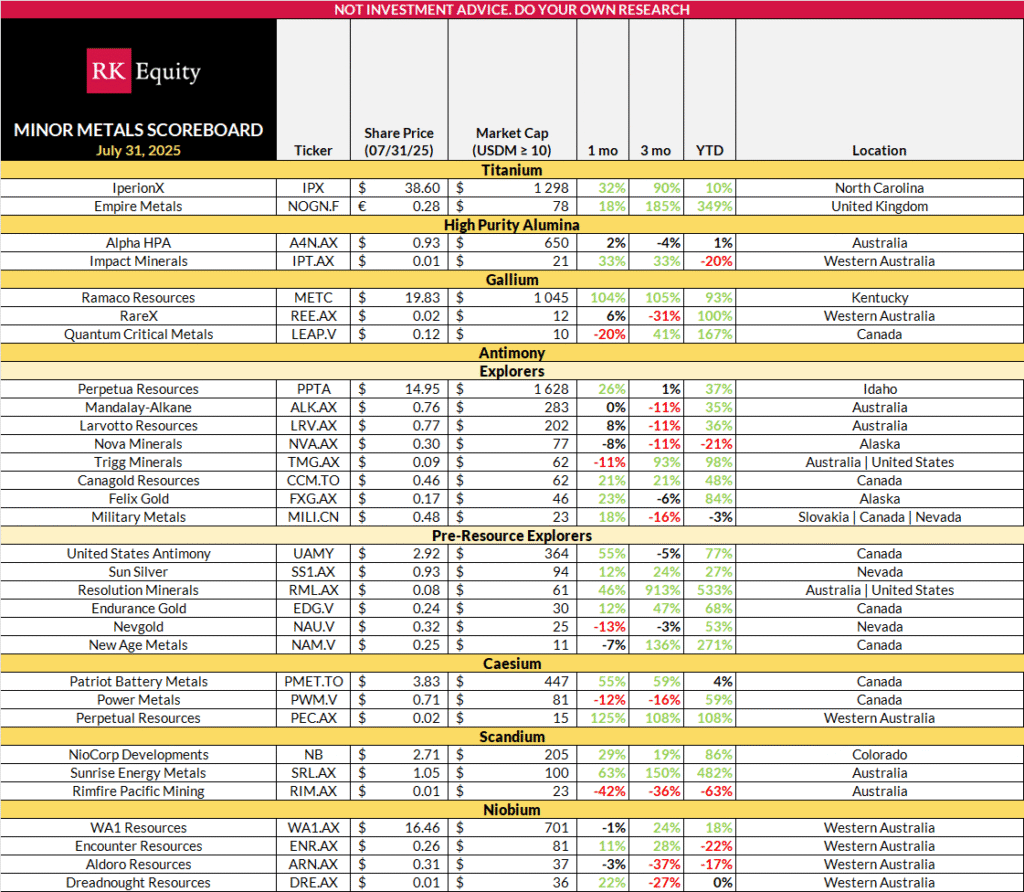

And, with new technologies, come non-traditional materials to support them. I’m talking about things like:

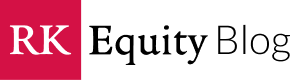

- Lithium and other battery raw materials like graphite, and high-purity manganese – not exactly household names prior to the last five years, but now their uses start to be recognised. The lithium market has grown multiple times since 2020, and further growth is set to follow.

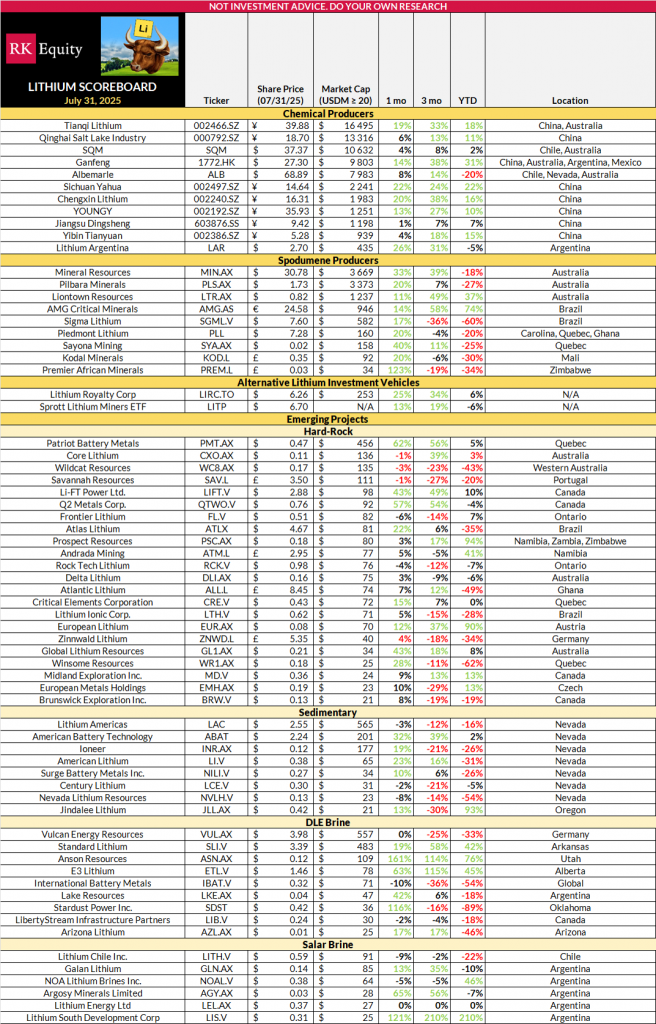

- Rare earths, which have been used extensively in electric vehicles and wind turbines, but are now branching out into other areas.

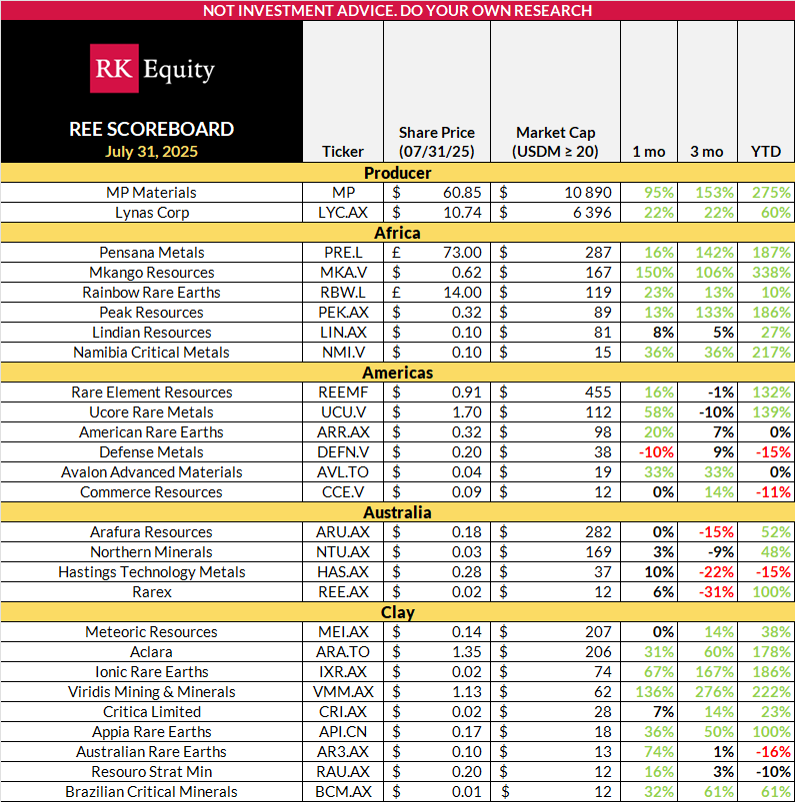

- Antimony and silver in solar panels. Antimony is used extensively in thin-film solar and in emerging perovskite and tandem solar cells.

- Gallium nitride in semiconductors, which is substituting for silicon in several key segments, including power converters and inverters, switching power, battery chargers and EVs, solar inverters and motors. It has a higher breakdown voltage than silicon and lower resistance, supporting energy efficiency and smaller form factors.

- Scandium, which is used in solid oxide fuel cells and increasingly in lightweight transportation alloys. There is growing interest in the use of scandium in renewable infrastructure such as solar panel frames and wind turbine parts.

- Germanium, which is used in high-efficiency solar cells, infrared optics, fibre optic cables and smart grid communications. It has emerging applications in high-mobility transistors for next-generation solar inverters.

- Niobium for superconducting magnets and high-strength alloys in cleantech.

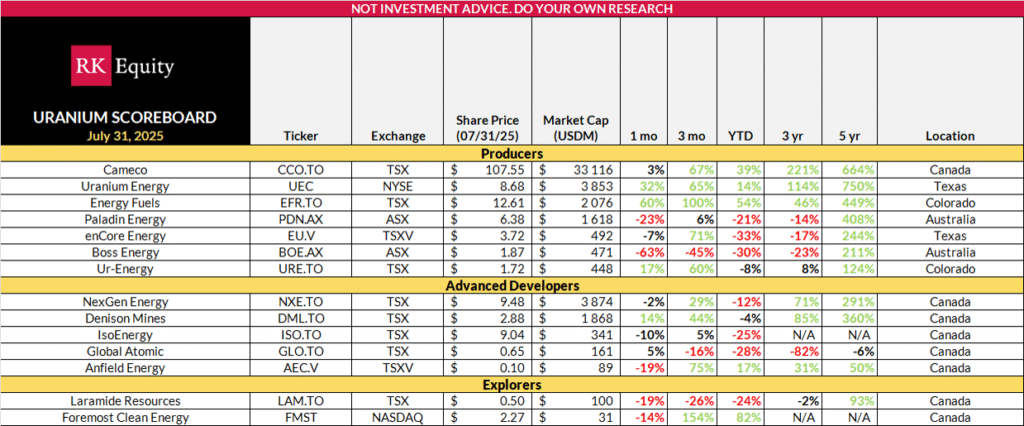

- Uranium, given the substantial build-out in nuclear capacity that’s going to be necessary to replace hydrocarbon-based baseload power sources.

This list, however, overlooks materials with slightly more developed industrial markets, such as cobalt, chromium, and vanadium, which also have growing applications in the AoE.

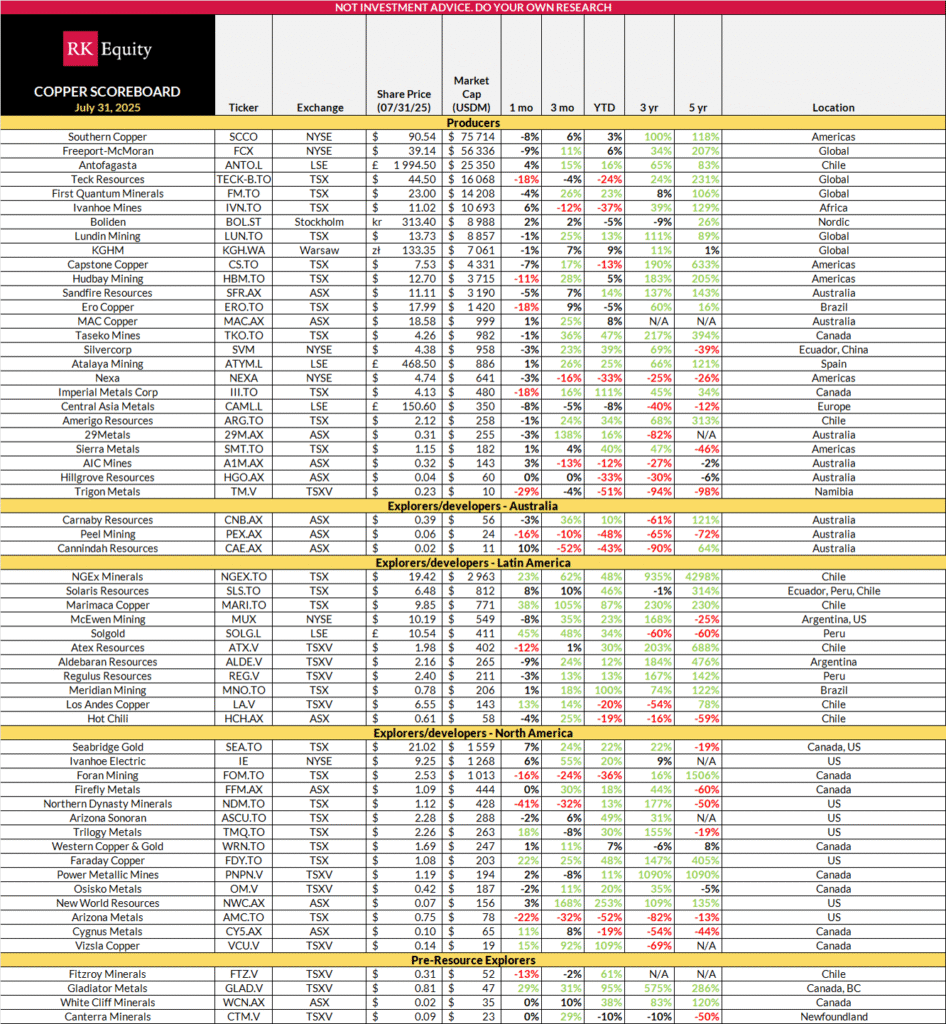

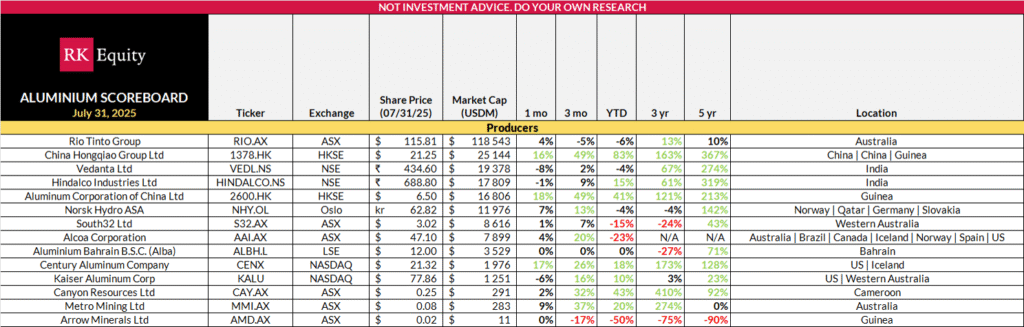

Of course, major base metals like aluminium, copper, and nickel have substantial uses in the AoE as well; however, while upside certainly remains in copper, as well as aluminium (which I’m bullish about for the first time in the past 15-20 years) and parts of the nickel sector, I feel that minor metals, because of their relatively small market sizes, have the potential to do much better in the coming secular demand event than metals with already large established markets.

One major similarity between the AoE and the China-led supercycle at the beginning of this century is that it was preceded by many years of underinvestment in supply preceding a super-normal demand shock. Another similarity is that the mining sector is a tiny proportion of global equity markets, so very small inflows into this thinly traded sector can now have outsized impacts, as they did then. Despite recent rallies, we are miles away from the pre-Fukushima uranium top in 2007, the rare earth squeeze in 2011 and the lithium boom in 2022.

RK Equity was among the first advisory firms to promote the major demand shocks that would transform minor metal lithium into a mainstream investment thematic. The RK Equity Lithium Scoreboard which is published monthly has become a go-to reference point for investors to assess how Mr. Market is evaluating producing and developing lithium juniors.

Having joined RK Equity last month in anticipation of new booms in many minor and some major metals, I am excited to announce a series of new RK Equity Scoreboards for Rare Earths, Silver, Copper, Uranium, Minor Metals and Aluminium.

For more information about any or all these metals and how RK Equity could be of assistance, please send me a direct message.

Matt Fernley